Mcgraw hill connect accounting answers chapter 2 – Delve into the realm of accounting with McGraw Hill Connect Accounting Answers for Chapter 2, your comprehensive guide to mastering the fundamentals of financial reporting. Embark on a journey through the intricate steps of the accounting cycle, deciphering the language of balance sheets, income statements, and cash flow statements.

Unlock the secrets of adjusting and closing entries, empowering you with the knowledge to navigate the complexities of financial transactions.

Chapter Overview: Mcgraw Hill Connect Accounting Answers Chapter 2

Chapter 2 of McGraw-Hill Connect Accounting introduces the accounting cycle and the three primary financial statements: the balance sheet, income statement, and statement of cash flows. It also covers adjusting and closing entries, which are essential for preparing accurate financial statements.

This chapter provides a comprehensive overview of the fundamental concepts and principles of accounting, laying the foundation for understanding how businesses track and report their financial activities.

Accounting Cycle

Steps in the Accounting Cycle

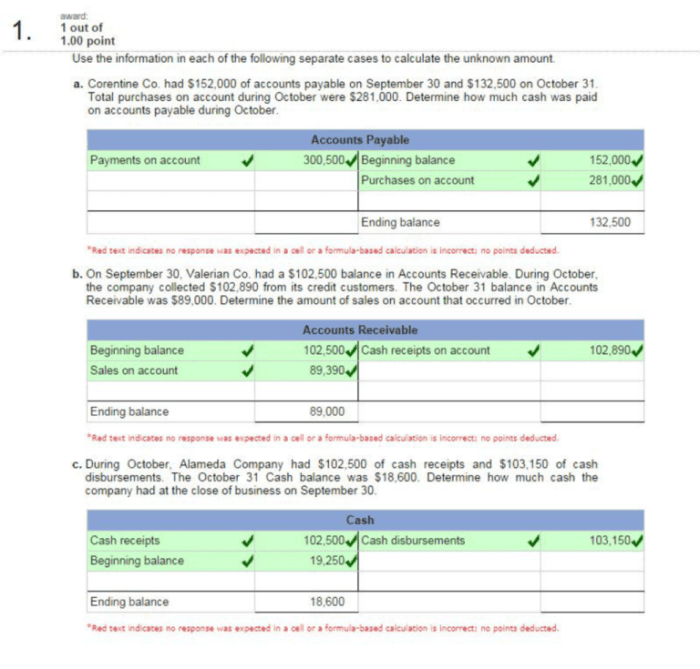

The accounting cycle is a systematic process that involves recording, processing, and summarizing financial transactions to prepare financial statements. The steps in the accounting cycle include:

- Analyzing transactions

- Recording transactions in a journal

- Posting transactions to the ledger

- Preparing a trial balance

- Adjusting entries

- Preparing financial statements

- Closing entries

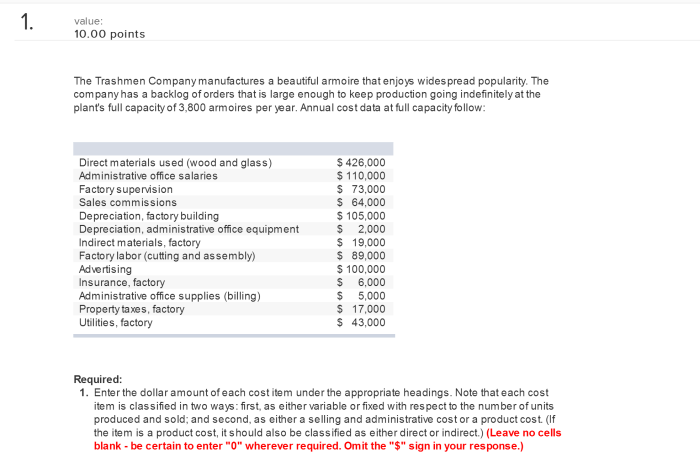

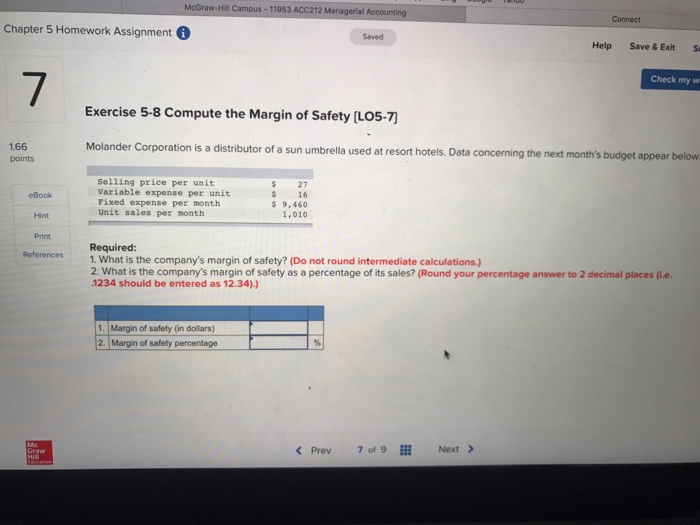

Financial Statements, Mcgraw hill connect accounting answers chapter 2

Balance Sheet

The balance sheet provides a snapshot of a company’s financial health at a specific point in time. It shows the company’s assets, liabilities, and equity.

Income Statement

The income statement shows a company’s revenues and expenses over a period of time, typically a quarter or a year. It is used to calculate a company’s net income or loss.

Statement of Cash Flows

The statement of cash flows shows how a company generates and uses cash. It tracks cash inflows and outflows from operating, investing, and financing activities.

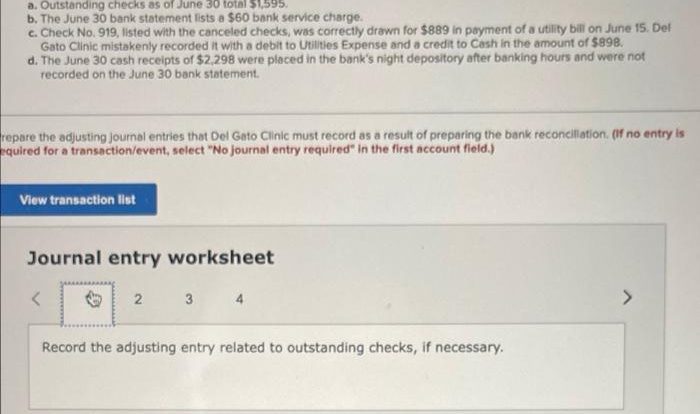

Adjusting Entries

Adjusting entries are made at the end of an accounting period to correct for transactions that have not yet been recorded or to reflect changes in account balances. Common adjusting entries include:

- Accrued revenue

- Accrued expenses

- Prepaid expenses

- Depreciation

Closing Entries

Closing entries are made at the end of an accounting period to transfer the balances of temporary accounts (revenue, expense, and drawing accounts) to the retained earnings account. This process resets the temporary accounts to zero for the next accounting period.

Reversing Entries

Reversing entries are made at the beginning of a new accounting period to reverse the effects of adjusting entries. This is done to ensure that the adjusting entries do not affect the balances of the accounts in the new period.

Question Bank

What are the key concepts covered in Chapter 2 of McGraw Hill Connect Accounting?

Chapter 2 delves into the accounting cycle, financial statements, adjusting and closing entries, providing a solid foundation for understanding financial reporting.

How does McGraw Hill Connect Accounting Answers help me understand the accounting cycle?

Through step-by-step explanations and illustrative examples, McGraw Hill Connect Accounting Answers clarifies the intricate process of recording and processing transactions, empowering you to master the accounting cycle.

What is the significance of financial statements in accounting?

Financial statements serve as the language of business, providing a snapshot of a company’s financial health and performance. McGraw Hill Connect Accounting Answers deciphers the purpose and format of each statement, equipping you to analyze and interpret financial data effectively.