Record the adjusting entry related to outstanding checks if necessary – Understanding and recording adjusting entries for outstanding checks is a crucial aspect of maintaining accurate financial records. This comprehensive guide will delve into the concept of outstanding checks, the purpose and procedures for recording adjusting entries, and best practices for managing them.

Outstanding checks represent checks issued by a company that have not yet cleared the bank. They can have significant implications on financial statements and require proper accounting treatment to ensure the accuracy and reliability of financial reporting.

Understanding Outstanding Checks: Record The Adjusting Entry Related To Outstanding Checks If Necessary

Outstanding checks are checks that have been issued by a company but have not yet been presented to the bank for payment. These checks are considered outstanding until they are either cleared by the bank or the payment date has passed.

Examples of outstanding checks include checks that have been mailed to vendors or employees but have not yet been cashed, checks that have been issued but have not yet been mailed, and checks that have been lost or stolen.

Outstanding checks can have implications on financial statements. For example, if a company has a large number of outstanding checks, it may appear to have more cash on hand than it actually does. This can lead to inaccurate financial reporting and make it difficult for investors and creditors to assess the company’s financial health.

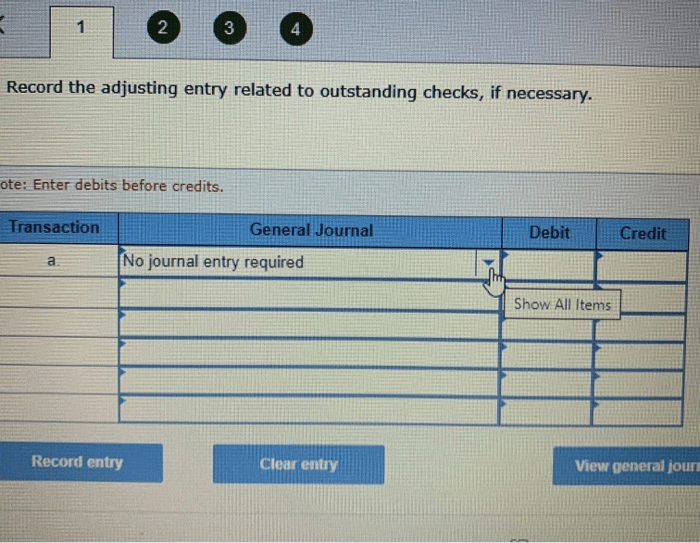

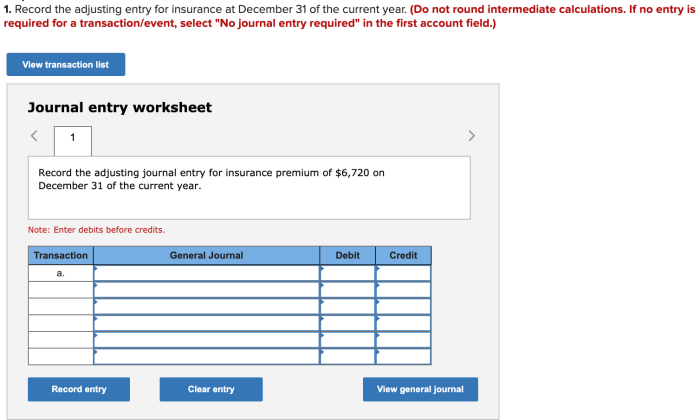

Adjusting Entry for Outstanding Checks

An adjusting entry for outstanding checks is an accounting entry that is made at the end of an accounting period to record the outstanding checks that have not yet been presented to the bank for payment.

To record the adjusting entry, follow these steps:

- Determine the amount of the outstanding checks.

- Debit the Cash account for the amount of the outstanding checks.

- Credit the Accounts Payable account for the amount of the outstanding checks.

The impact of the adjusting entry is to reduce the Cash account and increase the Accounts Payable account. This ensures that the financial statements reflect the true financial position of the company.

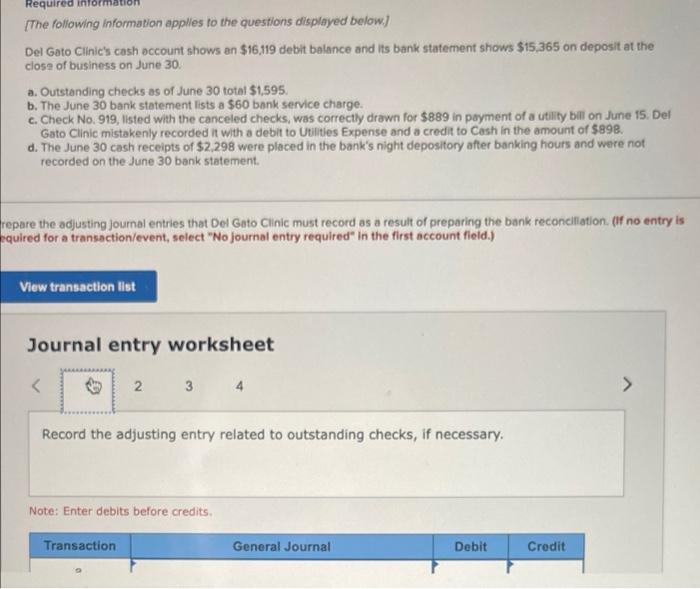

Procedures for Recording the Adjusting Entry

To identify outstanding checks, companies can use a variety of methods, such as:

- Reviewing the check register.

- Matching outstanding checks to invoices.

- Using a bank reconciliation statement.

Once the outstanding checks have been identified, the amount of the adjusting entry can be determined by adding up the amounts of the outstanding checks.

The adjusting entry should be recorded at the end of the accounting period, before the financial statements are prepared.

Best Practices for Managing Outstanding Checks

Companies can use a variety of best practices to manage outstanding checks, such as:

- Issuing checks only when necessary.

- Mailing checks promptly.

- Tracking outstanding checks using a check register or other system.

- Reconciling outstanding checks to the bank statement regularly.

- Using technology to track outstanding checks.

By following these best practices, companies can reduce the risk of errors and ensure that their financial statements are accurate.

Expert Answers

What is the purpose of an adjusting entry for outstanding checks?

Adjusting entries for outstanding checks are made to record checks that have been issued but not yet presented to the bank for payment. This ensures that the company’s financial records accurately reflect the outstanding liabilities.

How do I determine the amount of the adjusting entry?

The amount of the adjusting entry is equal to the total amount of outstanding checks as of the end of the accounting period.

When should I record the adjusting entry for outstanding checks?

The adjusting entry for outstanding checks should be recorded at the end of the accounting period, typically at the end of each month or quarter.