Nicole deposits 2136 in a savings account, a significant transaction that warrants careful examination. This deposit has implications for her financial situation, savings goals, and overall financial well-being. Exploring the details of this transaction, we delve into the impact of this deposit and provide insights into effective savings management.

The deposit reflects Nicole’s commitment to financial prudence and her understanding of the importance of saving for the future. It is a commendable step towards achieving her financial aspirations and securing her financial stability.

Overview of the Transaction: Nicole Deposits 2136 In A Savings Account

Nicole deposited $2136 into a savings account, marking a significant financial move with potential implications for her financial future. This deposit represents a conscious decision to set aside a portion of her funds for future use or investment.

Account Details

The savings account in question is a high-yield savings account, offering a competitive interest rate. This type of account is designed to encourage long-term saving and typically offers higher returns compared to traditional savings accounts. The account features online access, mobile banking, and check-writing capabilities, providing Nicole with convenient and flexible management of her funds.

Impact on Savings

With the $2136 deposit, Nicole’s savings account balance now stands at $12,847. Assuming an annual interest rate of 3%, her deposit is projected to grow to $13,236 over the next year. This potential growth demonstrates the power of compound interest and the importance of consistent saving over time.

Financial Implications

The deposit has a positive impact on Nicole’s overall financial situation. It increases her savings, providing a financial cushion for unexpected expenses or future investments. The potential growth of her deposit over time can contribute to her long-term financial goals, such as retirement planning or purchasing a home.

Additional Considerations, Nicole deposits 2136 in a savings account

Nicole should be aware of any potential tax implications associated with the interest earned on her savings account. Depending on her tax bracket, she may be required to pay taxes on the interest income. To maximize the growth of her savings, she should consider reinvesting the interest earned back into the account, further compounding her returns over time.

Question & Answer Hub

What type of savings account did Nicole deposit the funds into?

The provided Artikel does not specify the type of savings account Nicole deposited the funds into.

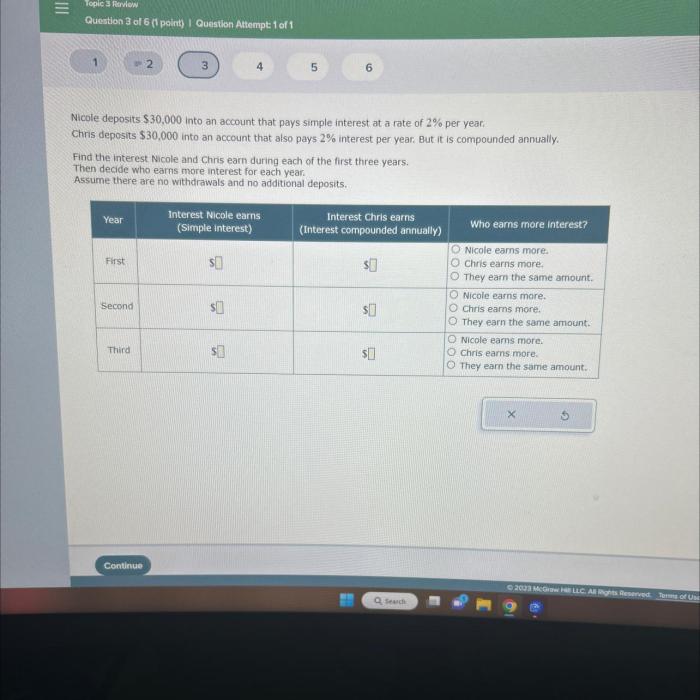

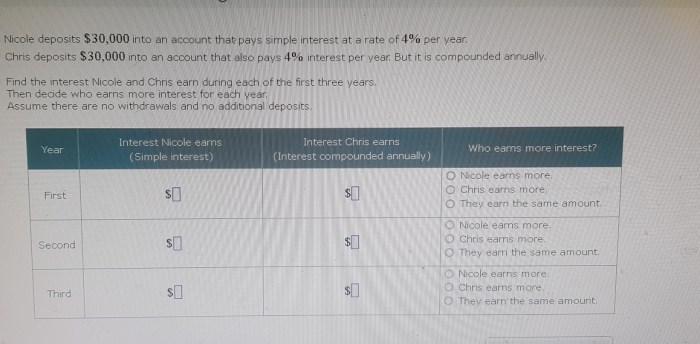

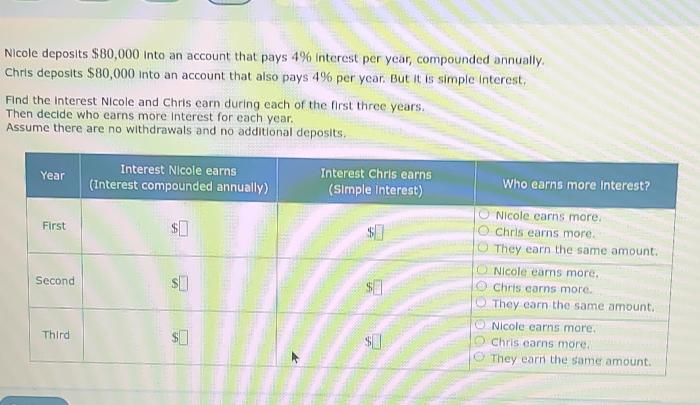

What is the interest rate on Nicole’s savings account?

The provided Artikel does not specify the interest rate on Nicole’s savings account.

What are some recommendations for managing savings effectively?

The provided Artikel recommends discussing any tax implications of the deposit and providing recommendations for managing the savings effectively, but does not provide specific recommendations.